How Non Profit can Save You Time, Stress, and Money.

Wiki Article

6 Easy Facts About Nonprofits Near Me Shown

Table of ContentsNpo Registration Fundamentals ExplainedRumored Buzz on Nonprofits Near MeAll about Non Profit Organizations ListNon Profit Organization Examples for DummiesThe Of Non Profit Organizations Near MeFascination About Non Profit Organizations ListThe 5-Second Trick For 501c3 NonprofitGetting The 501c3 Nonprofit To WorkNot For Profit Organisation Can Be Fun For Everyone

Incorporated vs - not for profit organisation. Unincorporated Nonprofits When individuals assume of nonprofits, they typically assume of bundled nonprofits like the American Red Cross, the American Civil Liberties Union Structure, as well as various other formally developed companies. Lots of individuals take component in unincorporated nonprofit organizations without ever realizing they have actually done so. Unincorporated nonprofit organizations are the outcome of 2 or more people working together for the objective of providing a public benefit or service.Personal structures may consist of family members foundations, private operating foundations, as well as company structures. As kept in mind over, they normally don't provide any type of services and instead use the funds they increase to support various other philanthropic organizations with service programs. Personal structures additionally tend to call for even more startup funds to establish the organization along with to cover legal costs and various other recurring expenditures.

The smart Trick of Non Profit That Nobody is Talking About

The properties continue to be in the trust fund while the grantor is to life and also the grantor may handle the properties, such as getting and also offering supplies or realty. All assets deposited right into or bought by the trust remain in the trust fund with revenue distributed to the marked beneficiaries. These counts on can survive the grantor if they include a provision for ongoing administration in the documents made use of to develop them.

Indicators on Irs Nonprofit Search You Should Know

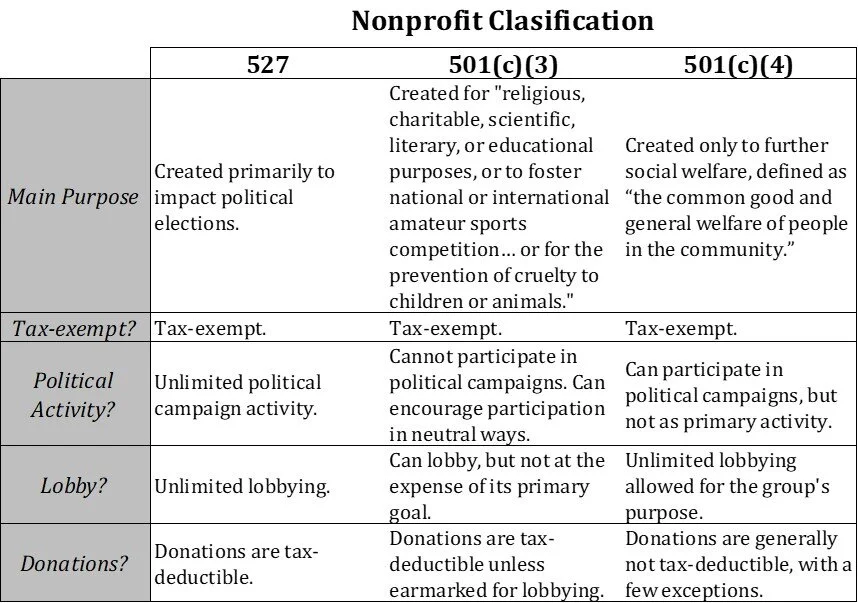

Additionally, you can hire a trust attorney to help you create a philanthropic trust and advise you on how to manage it moving on. Political Organizations While the majority of other kinds of nonprofit organizations have a minimal capacity to join or advocate for political task, political organizations run under click here to read different guidelines.

The Only Guide to Non Profit Organizations List

As you review your alternatives, make certain to talk to an attorney to identify the most effective approach for your company and also to ensure its correct configuration.There are many types of nonprofit organizations. All properties and revenue from the not-for-profit are reinvested right into the company or contributed.

3 Easy Facts About Npo Registration Explained

Some instances of well-known 501(c)( 6) companies are the American Farm Bureau, the National Writers Union, and also the International Organization of Satisfying Organizers. 501(c)( 7) - Social or Recreational Club 501(c)( 7) companies are social or entertainment clubs.

4 Simple Techniques For Not For Profit Organisation

501(c)( 14) - State Chartered Credit Score Union and also Mutual Book Fund 501(c)( 14) are state chartered credit unions as well as common get funds. These companies use financial solutions to their participants and the neighborhood, typically at discounted prices.In order to be qualified, a minimum of 75 percent of members need to exist or previous participants of the United States Army. Funding comes from donations and government gives. 501(c)( 26) - State Sponsored Organizations Providing Wellness Insurance Coverage for High-Risk Individuals 501(c)( 26) are nonprofit companies developed at the state degree to offer insurance for risky people that may not be able to obtain insurance coverage with other methods.

What Does 501c3 Organization Mean?

501(c)( 27) - State Sponsored Employee' Payment Reinsurance Company 501(c)( 27) not-for-profit companies are developed to supply insurance policy for workers' payment programs. Organizations that give employees settlements are required to be a member of these organizations and pay dues.A nonprofit corporation is an organization whose function is something apart from earning a profit. 501c3. A nonprofit contributes its earnings to accomplish a certain objective that benefits the web link public, rather of distributing it to investors. There more than 1. 5 million nonprofit companies signed up in the United States. Being a not-for-profit does not indicate the organization will not make an earnings.

The Basic Principles Of Npo Registration

No person person or group owns a nonprofit. Possessions from a not-for-profit can be offered, however it profits the entire organization instead than people. While any person can include as a nonprofit, just those who pass the rigid requirements stated by the government can achieve tax obligation exempt, or 501c3, standing.We review the steps to ending up being a nonprofit additional into this page.

More About 501c3 Organization

One of the most important of these is the capability to get tax "exempt" status with the IRS, which permits it to obtain contributions devoid of present tax obligation, permits contributors to subtract contributions on their revenue tax obligation returns and also exempts some of the company's activities from income tax obligations. Tax exempt status is essential to many nonprofits as it motivates contributions that can be made use of to support the objective of the organization.Report this wiki page